Year: 2025

Technology in Real Estate – Episode 9

In this episode of ‘Smart Real Estate with Westcliff,’ hosts Addy Saeed and Kaz Jaffer discuss the transformative impact of technology in real estate. They cover how AI, analytics, and automation are being used to identify better deals, manage properties efficiently, and scale operations. Key tools mentioned include Buildium, CoStar, Geowarehouse, and custom bots for market analysis. They emphasize the importance of transparency and investor confidence, enabled by real-time data, smart building tech, and comprehensive investor portals. Future trends such as blockchain, smart contracts, digital twins, and AI for portfolio management are also explored. Listeners are encouraged to embrace technology for smarter investment and management, and to join the Westcliff Investors network for deeper insights.

We hope you’ve learned something valuable in this episode. Subscribe to our podcast for more expert advice and visit westcliffam.com for more information.

Subscribe and tune in on your preferred platform to never miss an episode:

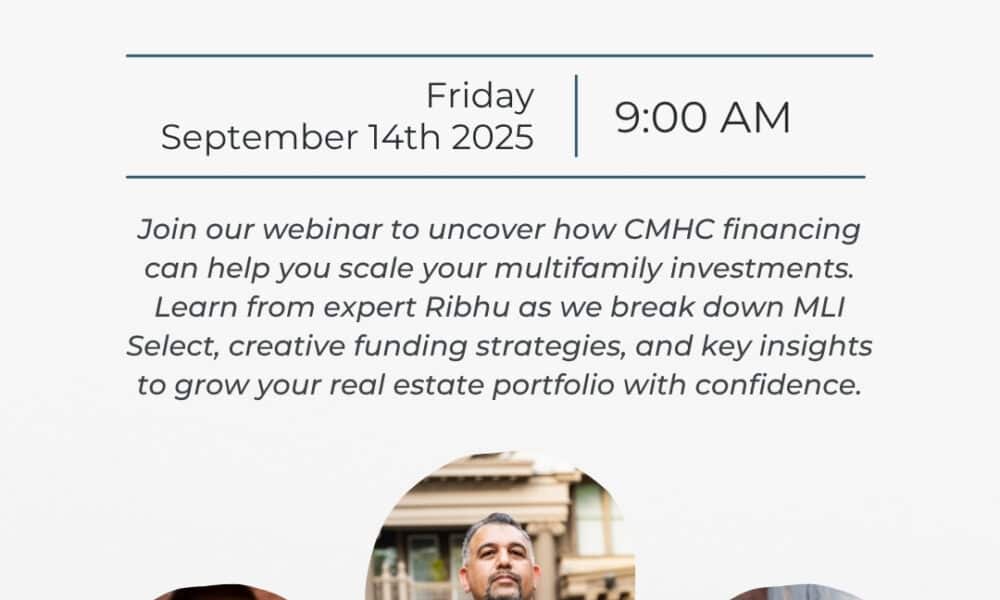

Thrive in 25 Webinar 8: CMHC Mortgages with Ribhu Rampersad

Introduction

In the ever-evolving landscape of real estate investment, one financing mechanism has secured its place as a cornerstone for multifamily property investment—CMHC (Canada Mortgage and Housing Corporation) financing. Recently, industry professionals Kaz Jaffer and Addy Saeed hosted a highly informative webinar featuring Ribhu Rampersad, an expert in commercial mortgages. The session provided valuable insights into the CMHC mortgage process, MLI select mortgages, and smart strategies for real estate investors.

Understanding CMHC Financing

CMHC acts as a mortgage insurer, offering investors favorable terms such as lower interest rates and extended amortizations, often up to 50 years. Ribhu clarified that CMHC’s multifamily loans have gained popularity as investors realize they can secure loans with as little as 5% down, thanks to up to 95% financing. However, Ribhu emphasized that while these terms are attractive, the deal must hold its value even without CMHC involvement to truly be considered a sound investment.

Differentiating Between Traditional and CMHC Mortgages

The discussion highlighted the comparative strengths of traditional versus CMHC mortgages. For instance, a conventional mortgage demands a higher upfront capital investment, whereas CMHC financing allows for lower capital outflow, potentially yielding higher returns. However, Ribhu cautioned potential investors to exercise due diligence in evaluating the property’s intrinsic value and to ensure the investment remains sound beyond the leverage available through CMHC.

Challenges with CMHC and MLI Select Mortgages

A significant part of the conversation involved the reality of securing the often-discussed 95% loan-to-value ratio. While this is more achievable in regions like Alberta due to affordable housing prices, it remains an elusive goal in Southern Ontario. Ribhu highlighted the importance of regulatory compliance and the potential pitfalls, such as the inability to secure MLI select mortgages for non-conforming properties.

The Importance of a Holistic Approach

For those new to CMHC financing, Ribhu underscored the necessity of working with seasoned professionals who understand the intricacies of commercial real estate transactions. Detailed financial analysis and a comprehensive understanding of the application’s documentation requirements can mean the difference between a successful deal and one mired in complications.

Utilizing Bridge Financing for Strategic Gains

Bridge financing emerged as a pivotal tool for many investors looking to expedite property acquisition or close deals where the seller seeks a quick transaction. According to Ribhu, bank-driven bridge loans remain competitive, offering prime rates, though private financing remains an option for more complex renovations.

Conclusion: Strategic Positioning for Long-Term Gains

Real estate investors face the dual challenges of navigating complex CMHC and MLI select mortgage criteria while ensuring their investment remains viable over long terms. As Ribhu advises, understanding both the opportunities and obligations of CMHC financing—such as amortization terms and income criteria—can empower investors to leverage these mortgages effectively.

In closing, real estate enthusiasts are encouraged to stay informed about market trends and regulatory changes. It’s essential to approach the multifamily investment space with both caution and confidence, recognizing the immense value CMHC financing can offer when applied judiciously.

For deeper insights and advice, potential investors are urged to reach out to industry professionals like Ribhu Rampersad or attend informative webinars such as the one hosted by Kaz and Addy. Your next step could be a guest appearance in this lucrative and expanding arena of real estate investment.

Advanced Real Estate Strategies – Episode 8

In this episode of Smart Real Estate with Westcliff, hosts Addy Saeed and Kaz Jaffer discuss advanced real estate strategies for high net worth investors. They focus on optimizing returns, minimizing risk, and building generational wealth through structured planning. Key topics include ownership structures (holdcos, opcos, and trusts), advanced financing options (CMHC insured financing, vendor take-back mortgages, mezzanine debt, and bridge loans), and exit strategies that consider tax implications. They emphasize the importance of a strategic and diversified approach to real estate investing. Listeners are encouraged to book strategy sessions and join the Westcliff Investors Network for further learning and opportunities.

We hope you’ve learned something valuable in this episode. Subscribe to our podcast for more expert advice and visit westcliffam.com for more information.

Subscribe and tune in on your preferred platform to never miss an episode:

Sustainable Investing Focused Session – Episode 7

In this episode of Smart Real Estate with Westcliff, hosts Addy Saeed and Kaz Jaffer explore the importance of ESG—Environmental, Social, and Governance—in real estate investing. They explain how sustainable practices can attract premium tenants, better financing, and quicker exits. The episode highlights the benefits of integrating ESG, such as efficient HVAC systems, social inclusion, ethical governance, and how these features reduce operating costs, retain tenants longer, and enhance asset value. Real-world examples, such as a project in Ontario that achieved LEED Gold standards, demonstrate the practical advantages. The episode concludes with an invitation for listeners to book strategy sessions and join the Westcliff investors network for further insights.

We hope you’ve learned something valuable in this episode. Subscribe to our podcast for more expert advice and visit westcliffam.com for more information.

We hope you’ve learned something valuable in this episode. Subscribe to our podcast for more expert advice and visit westcliffam.com for more information.

Legal Considerations in Real Estate – Episode 6

In this episode of ‘Smart Real Estate with Westcliff,’ hosts Addy Saeed and Kaz Jaffer delve into the often overlooked yet crucial aspect of real estate investing: legal structures. They emphasize that even the best deals can fail without proper legal frameworks. The discussion covers various investment structures such as joint ventures, limited partnerships (LPs), REITs, and MICs, highlighting the importance of clear, written agreements. Key documents like subscription agreements, offering memorandums, and LP agreements are explained, stressing their role in protecting investors. They also outline the stringent compliance measures Westcliff follows as a registered dealing representative, which safeguard clients from fraudulent deals. For more detailed guidance, viewers are encouraged to book sessions and join the Westcliff Investors network. The episode concludes with a teaser for the next topic: sustainable investing.

We hope you’ve learned something valuable in this episode. Subscribe to our podcast for more expert advice and visit westcliffam.com for more information.

We hope you’ve learned something valuable in this episode. Subscribe to our podcast for more expert advice and visit westcliffam.com for more information.

Market Trends and Analysis – Episode 5

In this episode of ‘Smart Real Estate with Westcliff,’ hosts Addy Saeed and Kaz Jaffer discuss the importance of data-driven strategies in real estate investing. They highlight five major trends shaping the Canadian real estate market: interest rate volatility, housing supply crisis, immigration and demographics, affordability pressures, and institutional retreat. The hosts emphasize that understanding these trends is crucial for making informed investment decisions. Practical insights are shared on analyzing cap rates, rental trends, and policy changes, demonstrating how Westcliff leverages local intelligence and macro analytics to identify opportunities and navigate the market proactively. Listeners are invited to book a one-on-one session for tailored investment advice and to join the Westcliff investors network for exclusive insights. The episode ends with a preview of the next topic, focusing on the legal aspects of investing.

We hope you’ve learned something valuable in this episode. Subscribe to our podcast for more expert advice and visit westcliffam.com for more information.

Investment Opportunities Breakdown – Episode 4

In this episode of Smart Real Estate with Westcliff, Addie Saeed and Kaz Jaffer provide an inside look at how they evaluate and present real estate investment opportunities. They discuss their focus on mid-market real estate projects, which include unstabilized income properties, value-add opportunities, and development projects. The episode outlines the components of the Westcliff Investor Network (WIN) package, which includes detailed financial projections, risk assessments, and live walkthroughs with investors. The hosts emphasize the importance of realistic business plans, conservative assumptions, and aligned sponsor interests. They also encourage signing up for WIN to get first access to vetted investment opportunities and stress the educational nature of their podcast, recommending consulting a licensed advisor for financial decisions.

We hope you’ve learned something valuable in this episode. Subscribe to our podcast for more expert advice and visit westcliffam.com for more information.

Subscribe and tune in on your preferred platform to never miss an episode:

Risk Management Strategies – Episode 3

Addy Saeed and Kaz Jaffer from Smart Real Estate with Westcliff discuss the critical aspects of risk management in real estate investing. They emphasize the importance of understanding, planning for, and structuring around various risks such as market risk, asset-level risk, financial risk, and legal/operational risk. They share strategies like due diligence, stress testing, maintaining reserves, and diversifying investments to protect and optimize capital. Listeners are invited to book a strategy session and join the Westcliff investors network for early access to deals and further insights.

We hope you’ve learned something valuable in this episode. Subscribe to our podcast for more expert advice and visit westcliffam.com for more information.

Subscribe and tune in on your preferred platform to never miss an episode:

Canadian Real Estate in Late 2025: A Market of Diverging Trends and Strategic Opportunities

Executive Summary

The Canadian real estate market is navigating a period of significant transition in late 2025. A sharp 16% month-over-month decline in housing starts in August underscores the pressure from higher financing costs and economic uncertainty . While the national market is cooling, performance varies dramatically by region, creating a complex landscape for investors. This report, drawing on the latest data from CREA, CMHC, and other leading sources, breaks down the current trends and identifies the strategic opportunities emerging in this new environment.

National Market Overview: Cooling Construction and Balanced Resales

The most recent data reveals a market grappling with macroeconomic headwinds, yet showing signs of gradual rebalancing.

- Housing Starts Slow Down: The annual pace of housing starts fell significantly to approximately 245,791 units in August, a 16% drop from July . This slowdown reflects growing caution among developers due to high construction costs, tighter financing conditions, and softened demand.

- Resale Market Stabilizes: In contrast to new construction, the resale market is stabilizing. August saw a 1.1% increase in sales from the previous month, marking the fifth consecutive monthly gain . With new listings rising by 2.6%, the national sales-to-new-listings ratio (SNLR) settled at 51.2%, indicating a balanced market where neither buyers nor sellers have a decisive advantage .

- Price Moderation: The aggregate MLS® Home Price Index (HPI) was largely unchanged from July to August, with the national benchmark price of $686,800 representing a 3.4% decrease from August 2024 . This suggests that increased supply is helping to temper price growth.

Regional Divergence: A Tale of Multiple Markets

The national story is fragmented at the provincial level, highlighting the critical importance of local market analysis. The table below illustrates the stark contrasts in benchmark prices and market conditions across Canada for August 2025 .

| Province | Benchmark Price (August 2025) | Annual Change | Market Type (SNLR) |

|---|---|---|---|

| Newfoundland | $337,600 | +12.3% | Seller’s Market (77%) |

| Saskatchewan | $372,200 | +8.0% | Seller’s Market (71.4%) |

| Quebec | $526,100 | +7.9% | Seller’s Market (63%) |

| Alberta | $515,300 | -0.1% | Seller’s Market (63%) |

| Ontario | $787,500 | -6.7% | Balanced Market (43%) |

| British Columbia | $942,800 | -3.1% | Balanced Market |

Data sourced from WOWA’s Canadian Housing Market Report, based on CREA data .

As the table shows, Ontario and British Columbia, which heavily influence the national average, are experiencing the most significant price corrections. Meanwhile, more affordable provinces like Newfoundland, Saskatchewan, and Quebec are seeing robust price growth, often in seller’s market conditions . Calgary is also noted as a top market to watch for its resilience .

Key Market Drivers and Headwinds

Several interconnected factors are shaping the current market trajectory:

- Economic and Trade Uncertainty: Lasting trade tensions, particularly tariffs with the U.S., are creating economic uncertainty, dampening business investment, and contributing to a weaker growth outlook . This environment encourages a “wait-and-see” approach among both buyers and developers.

- Interest Rates and Affordability: Although the Bank of Canada has begun cutting rates, with a 25-basis-point reduction in mid-September, mortgage rates remain elevated compared to the past decade . Affordability continues to be a major barrier for prospective buyers, especially in high-cost markets.

- Shift in Investor Sentiment: The era of “cheap and plentiful capital” is over . Investors are now more risk-averse, carefully weighing real estate against other asset classes. This has led to a growing interest in niche property types like data centres, cold-storage facilities, and purpose-built rental housing, which are seen as among the best bets for 2025 .

Investment Implications and Strategic Outlook

For investors, the current environment demands a strategic and nuanced approach.

- Focus on Resilient Assets: In a period of economic uncertainty, investors are showing a preference for lower-risk, stable asset classes. Purpose-built rental housing and essential retail (e.g., grocery-anchored strips) offer more predictable cash flows .

- Embrace Niche Opportunities: The search for yield is driving capital towards niche sectors. Real assets that blur the line between real estate and infrastructure, such as student housing and the aforementioned data centres, are attracting attention from investors with strong convictions about long-term demographic and technological trends .

- Prioritize Operational Excellence: Success in the current market is less about speculation and more about operational efficiency. Innovative financing, strategic partnerships, and a focus on sustainability are key to navigating uncertainty and driving growth .

- Long-Term Perspective: The CMHC forecasts a gradual recovery starting in 2026 as trade tensions are expected to ease and economic conditions improve . For investors with a long-term horizon, the current cooling period may present acquisition opportunities.

Conclusion

The Canadian real estate market in late 2025 is defined by its regional contradictions and a transition toward more balanced conditions. While headwinds from trade policy and affordability are suppressing activity in major markets like Ontario and B.C., more affordable regions are displaying remarkable resilience. For sophisticated investors, success will hinge on meticulous local market analysis, a focus on stable or niche asset classes, and the operational expertise to manage assets effectively through a period of economic uncertainty. The market may be cooling, but for those with the right strategy, opportunities are very much present.

This analysis synthesizes the latest data from the Canada Mortgage and Housing Corporation (CMHC), the Canadian Real Estate Association (CREA), PwC Canada, NerdWallet, and WOWA to provide a comprehensive overview for investors .

Navigating Financial Aspects of Real Estate – Episode 2

In this episode of ‘Smart Real Estate with Westcliff,’ hosts Addy Saeed and Kaz Jaffer delve into the financial aspect of real estate investing. They discuss the capital stack, financing strategies, and key financial metrics such as internal rate of return (IRR), cash-on-cash return, and equity multiple. The episode also covers tax optimization strategies and how different account types can impact tax-efficient investing. A detailed example of a 40-unit apartment building is provided to illustrate these concepts. The hosts emphasize the importance of a well-structured financial plan and offer resources for further assistance, including strategy sessions and the Westcliff Investors network. The episode concludes with a teaser for the next topic on risk management strategies.

We hope you’ve learned something valuable in this episode. Subscribe to our podcast for more expert advice and visit westcliffam.com for more information.

Subscribe and tune in on your preferred platform to never miss an episode: